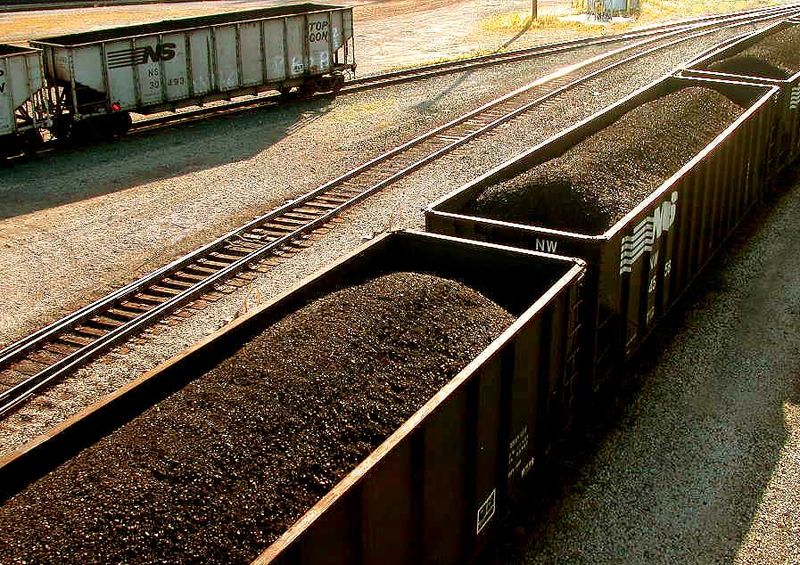

But America’s natural gas revolution is affecting more than the domestic market. It’s also fueling the debate over coal exports. As natural gas displaces coal in the United States, energy companies are looking to export more coal overseas—much of it headed to China and other Asian markets. Doing so requires the approval and construction of several new coal export terminals on the Pacific coast.

Environmental groups have opposed coal exports over concerns about their effect on climate change. In August, Oregon officials rejected a permit to construct a terminal that would export 8.8 million tons of coal each year. Several larger terminals, however, still await approval.

How would additional coal exports impact climate change? It’s not so simple, says Frank Wolak, a 2014 PERC Lone Mountain Fellow. Wolak is a professor of economics at Stanford University, where he directs the Program on Energy and Sustainable Development. We asked Wolak about coal exports during his research fellowship at PERC this summer.

Q: Over the past several years, U.S. natural gas prices have plummeted, causing electric utilities to shift to natural gas-fired generators instead of coal. What does the U.S. natural gas revolution mean for the rest of the world?

A: Because there are no liquefied natural gas (LNG) export facilities currently operating in the United States, this natural gas is trapped here until at least one of the export facilities currently under construction begins operation. As a result, current prices of natural gas in Europe are two to three times higher than those in the United States, and LNG prices in Asia are three to four times higher than U.S. prices. However, the shale gas revolution and resulting decline in domestic natural gas prices has led to a significant decline of coal use in the U.S. electricity sector, which has led to a decline in domestic coal prices. These lower coal prices have contributed to increased U.S. coal exports to Europe and Asia.

Q: You have argued that coal exports to China and other countries will actually reduce greenhouse gas emissions globally. Why is that?

A: I have argued that expanding western U.S. port capacity to allow a significant increase in exports of Powder River Basin coal to Asia will likely lead to reduced global greenhouse gas emissions. This argument relies on the fact that China has virtually no natural gas-fired electricity generation units and a limited amount of nuclear, hydroelectric, and wind generation units.

However, China currently obtains more than 80 percent of its electricity from coal-fired generation units. During each of the past ten years, China built more than the installed generation capacity of California—approximately 60 gigawatts—in new coal-fired power plants. These generation facilities have a useful life of more than 30 years, so China’s demand for coal is unlikely to decline in the foreseeable future.

Although there is plenty of coal available in Indonesia, Australia, and South Africa to meet China’s and the rest of Asia’s imported coal needs, increasing western U.S. port capacity can allow a significant amount of Powder River Basin coal to be sold in Asia. The increase in U.S. coal demand caused by these exports will increase domestic coal prices and further increase the relative price of producing electricity from coal relative to natural gas in the United States. Consequently, increased coal exports to Asia will yield no net change in greenhouse gas emissions from China and other Asian countries. Instead, they will yield a reduction in U.S. greenhouse gas emissions because of the shift from coal to natural gas-fired generation brought about by the higher U.S. coal prices caused by the substantially higher coal exports to Asia.

Q: Some say that blocking coal exports would keep U.S. coal reserves underground and therefore reduce global carbon emissions. Is that not the case?

A: The total amount of coal consumed globally is a major driver of global greenhouse gas emissions. Over the past decade, coal has been the world’s fastest growing fossil fuel and virtually all of this growth has occurred in developing countries. There is plenty of coal available outside of the United States to meet this rapidly growing global demand. Blocking U.S. coal exports is therefore unlikely to have a noticeable impact on global coal consumption, only the total employment in the U.S. coal sector and port sector.

Q: Others argue that blocking coal exports will encourage China to look for cleaner energy sources or adopt energy efficiency measures.

A: China already has the most wind generation capacity of any country in the world and the most energy-efficient fleet of coal-fired generation units in the world, largely because the vast majority of these units have been built in the past ten years. It is unrealistic to expect China to abandon its massive investments in coal-fired generation capacity over the past decade, particularly given that there is plenty of coal available to meet its needs for the foreseeable future.

Q: What prevents China and other countries like Australia and Indonesia from switching to natural gas, as the U.S. has done?

A: Currently, China has no significant domestic natural gas supplies. Australia relies primarily on coal-fired generation units, in spite of having significant natural gas reserves, because it also has extremely inexpensive-to-extract brown and black coal reserves.

Asian countries are willing to pay oil-indexed prices for Australia’s natural gas, so very little is currently used to produce electricity. A similar situation exists in Indonesia, which also exports natural gas and coal. This state of affairs could change as these countries attempt to exploit their shale gas reserves. The U.S. Energy Information Administration estimates that China has even larger shale gas reserves than the United States. Consequently, China could potentially become a major producer and consumer of natural gas if it is able to exploit these reserves.

Q: If China has such large shale reserves, what are the prospects for a future natural gas revolution in China—or anywhere else?

A: How fast China will develop its shale gas reserves is anyone’s guess. There are a number of reasons to believe that it will be a slow process. First, shale gas exploration requires significant volumes of water, which is in short supply in China. Second, the property rights regime in China is not as conducive to landowner support of shale gas exploration as it is in the United States. Finally, the geology of China’s shale gas reserves is significantly different from that in the United States.

It’s worth noting that Chinese firms are significant partners in a number of U.S. shale gas plays. In addition, virtually all major U.S. oil and gas firms are currently involved in partnerships to develop China’s shale gas reserves.

Q: Where does renewable energy fit into all of this?

A: Wind and solar generation units produce approximately five percent of U.S. electricity consumption. In contrast, coal, natural gas, and nuclear generation units produce more than 80 percent of electricity consumption. At current U.S. coal and natural gas prices, wind and solar technologies cannot compete with natural gas and coal-fired generation units on a levelized cost basis (lifetime average cost per kilowatt-hour) without government support, and it is unclear whether state and federal governments will continue to provide financial support for renewables at current levels. Consequently, it is reasonable to expect that the U.S. electricity sector will continue to depend primarily on fossil fuel generation units.

Frank Wolak’s responses are based on a forthcoming paper with Michael Miller.