When most people think about climate adaptation, they think of sea walls, levees, dams, and other massive infrastructure projects that reduce our exposure to extreme weather. While these projects can be effective in some cases, uncertainty about future conditions—both climatic and economic—often poses significant and costly design challenges. By focusing on large infrastructure projects, we often overlook another means by which we can adapt to a changing climate: financial markets.

Financial instruments have long been used to manage uncertainty in economic conditions. Futures markets and options contracts, for instance, are commonly used to reduce risk and hedge against uncertain outcomes. So why not look to financial markets to manage risks related to a changing climate? The answer is that, to some extent, we already are.

Recent financial innovations are creating new tools specifically designed to mitigate the impacts of extreme environmental conditions. But more could be done. If the long-run goal is to minimize the cost of a changing climate, a greater reliance on these financial strategies could be less expensive and more flexible than depending on traditional concrete-and-rebar physical adaptations, particularly when the events of concern are low probability and high impact.

The Drought of 2012

Financial contracts can serve two beneficial functions when it comes to adaptation to climate change: First, they provide a hedge against financial losses related to environmental shocks, and second, they provide important price signals that help coordinate the mitigation of other risks.

Financial strategies could be less expensive and more flexible than traditional concrete-and-rebar physical adaptations.

To illustrate the value of these two functions, consider the U.S. drought of 2012-13, which dramatically reduced crop yields across the Midwest and nearly brought barge traffic on the Mississippi River to a standstill due to receding water levels. This event offers insight into how financial markets can limit the impacts of extreme weather and demonstrates the potential value of using these strategies to adapt to changing climate conditions.

In June 2012, water levels on the lower stretches of the Mississippi River had fallen so low that fully loaded barges were at risk of running aground. In response, the U.S. Coast Guard restricted barge drafts (the distance from the water surface to the bottom of the hull) to just 10.5 feet, a foot-and-a-half less than normal. The result was that the average barge’s cargo capacity fell by about 300 tons—a loss of more than 7,000 tons per 24-barge tow.

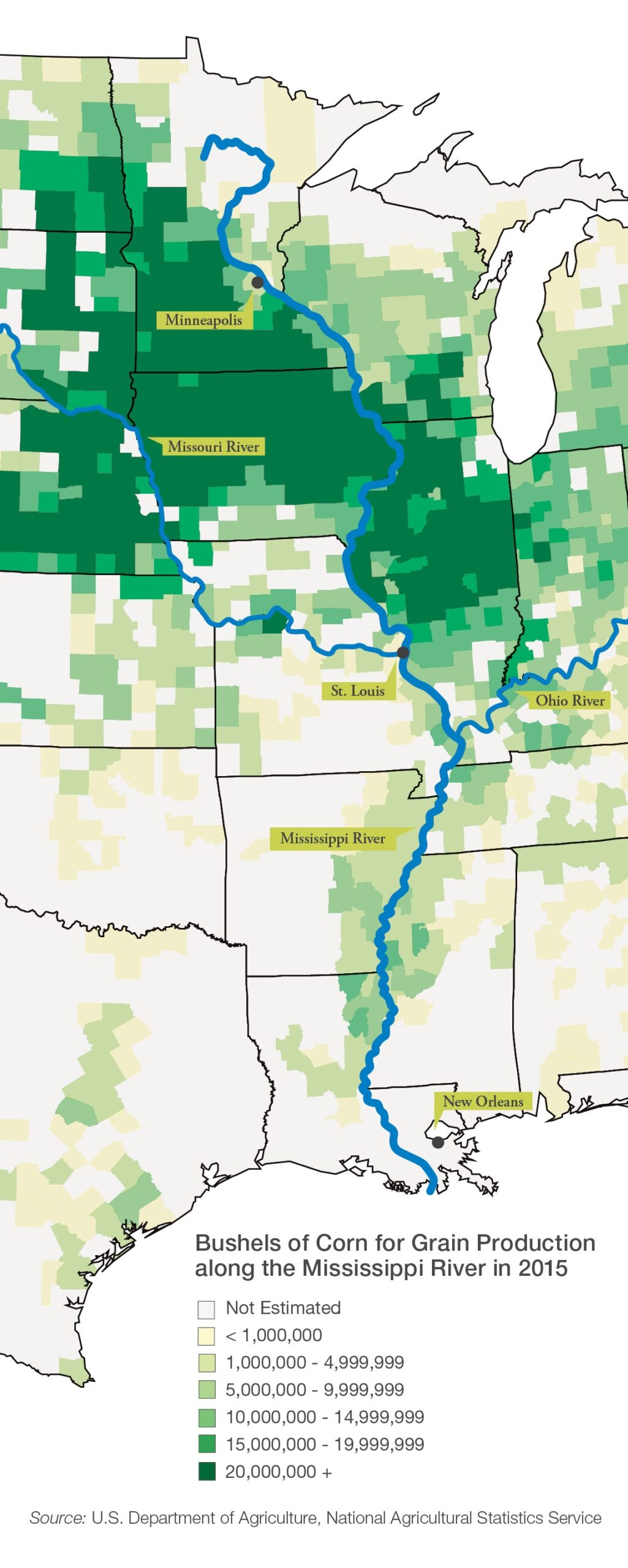

Shippers and carriers panicked, eventually leading to a flurry of emergency dredging by the U.S. Army Corps of Engineers. But transportation on the river was far from the only consequence of the drought. Agricultural yields were also affected. The corn crop was hardest hit, with the harvest ending up 26 percent below the U.S. Department of Agriculture’s pre-drought prediction. By the time rain arrived in early 2013, the drought had cost the United States approximately $32 billion in total, almost $5 billion of which was a reduction in net farm income.

What Prices Reveal

The 2012 drought was a complicated event with consequences that reverberated throughout the economy. Prices, though, give us a window into how various market actors adapted their strategies—both logistic and financial—to manage the impacts of the drought.

In the case of corn, market prices convey information about not only current conditions but also expectations about the future, allowing people to make the best decisions about where and when they should buy, sell, or transport the commodity. For example, if prices in downriver markets are high relative to upriver markets, corn sellers will be more inclined to pay the costs of transporting their product to the downriver markets. Or if navigation disruptions are expected to halt barge traffic in the near future, as happened during the 2012 drought, then corn marketers may be more likely to either hold corn in storage or sell it into upriver domestic markets.

In 2012, spot prices revealed one important logistical reaction to the drought. Rather than sending corn to export ports near New Orleans at high cost (either on the river or via more expensive overland modes), many marketers instead sold corn into upriver domestic markets for use in animal feed or ethanol. U.S. corn exports fell 52 percent from the year before, making it one of the few years that the United States was not the world’s leading corn exporter. By contrast, American producers used only 6 percent and 5 percent less corn for feed and ethanol respectively, a small reduction considering the poor harvest.

The 2012 drought was a complicated event with consequences that reverberated throughout the economy. Prices give us a window into how various market actors adapted their strategies—both logistic and financial—to manage the impacts of the drought.

While spot prices give insights into the logistical tradeoffs of bringing corn to market, forward prices tell us how valuable logistical flexibility can be for adapting to future drought expectations. In the case of corn, there are robust forward markets at multiple locations along the Mississippi River. Forward prices are agreed upon today for corn delivery at some point in the future (for example, “the first business day of December,” or “30 days from now”). These contracts act as an important risk management tool by providing a hedge against sudden corn price changes, including those related to increases in transportation costs due to disruptions in river navigation. As opposed to futures contracts—which are similar in function but traded on a centralized exchange—forward contracts are location specific. This allows them to provide a better hedge against environmental shocks that affect financial outcomes on local levels. During the 2012 drought, forward contracts were important for corn markets because navigation disruptions affected different sections of the Mississippi River at different times.

Forward prices can also reveal a great deal of information about expected future environmental and economic conditions. In fact, prices help organize market-wide responses to shifts in environmental conditions prior to their onset. This allows interested parties to glean information about future conditions just by looking at prices, rather than having to make their own predictions about the future. Empowered with this information, producers and consumers can make decisions today that may help mitigate losses in the future. And because prices can adjust quickly to new information, these adaptations can be incredibly powerful if the probability or magnitude of extreme events changes in the future. In stark contrast, dams and sea walls cannot easily be disassembled, altered, or rebuilt elsewhere when new information becomes available.

When Paper Beats Rock

Extreme droughts like the one in 2012 are nothing new. In fact, a similar drought occurred on the Mississippi River in 1988. But the parameters of drought could be changing. Scientists predict that climate change could make droughts longer and more frequent in some places but shorter and less frequent in others. Either way, this much is clear: We face a future of increased uncertainty, where historic probabilities and magnitudes of extreme droughts may no longer be representative of future risk.

Often, the first instinct when confronted with this uncertainty is to think immediately of physical adaptations. In fact, this was the exact response by many parties during and after the 2012 drought. Industry groups and shippers immediately began lobbying the Army Corps to implement emergency dredging operations to alleviate navigation restrictions. As conditions worsened, there were requests for additional interventions, such as altering the operating rules of upstream Missouri River dams to provide increased flows on the Mississippi. Some called for increased investment in physical infrastructure to guard against future emergencies.

Because infrastructure is usually unchangeable, or at least very expensive to alter, and its lifetime can span many decades, infrastructure projects can be troublesome if weather conditions deviate from the projections used at the time they were built. Over- or under-design could lead to over- or under-investment in such projects—a serious issue for both public and private investors, especially when most of these projects are financed with debt.

Financial adaptations avoid these problems. They don’t require long-term investment and can be modified in the face of changing conditions. While financial markets can’t entirely prevent losses, they spread them out and allow exposed parties to pursue strategies that can avoid some of the most devastating financial outcomes. And in most cases, the best adaptation strategies will likely involve a combination of the two. Identifying the trade-offs between the array of financial and physical options available is an ongoing and innovative area of study.

The Future of Adaptation

As a commodity, corn has obvious advantages that make it especially adaptable in financial markets: It can be stored. It can be moved by barge or rail. It can be sold in a variety of markets. It has well-developed forward and futures markets. An important question is whether financial adaptations could have the same potential for other important resources affected by a changing climate.

Even if this is not yet the case in other markets, innovations in financial contracts that target specific environmental risks could become useful in a variety of settings. Weather derivatives have long been used in energy markets, and more environmentally indexed derivative or insurance contracts are being used to manage environmental risk in other settings. Catastrophe bonds have also become popular for managing high-cost, low-probability risks.

Developing a better understanding of how markets react to environmental shocks could change the way we think about climate adaptation. In particular, it could alter how we evaluate traditional infrastructure adaptations. It might also highlight opportunities for entrepreneurs to create new financial products to address environmental risks, which would help all of us adapt to the uncertainties of a changing world.