Diagnoses and prescriptions abound, but nowhere are two key parameters to successful agricultural production mentioned—land tenure and secure property rights. These are highly political issues throughout Africa, which agricultural “experts” tend to shy away from, preferring instead to seek refuge behind the façade of technical fixes.

In Kenya there are abundant data showing the striking gains to be made in economic productivity and environmental management on land farmed under secure property rights. These data are of real significance to the debate on raising agricultural productivity and the standards of land management throughout Africa.

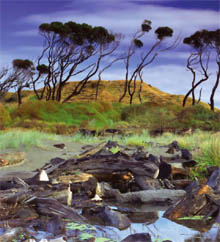

EVOLUTION OF LANDSCAPES

In the 1930s, rural population densities in Machakos District, Kenya, just east of Nairobi, were around 40–50 persons to the square kilometer (0.4 square miles). Photographs (page 34) show eroded landscapes with poor standards of land management, and the dramatic transformation 50 years later. Rural population densities, at 500 people per square kilometer, are now ten times higher, standards of land management have improved, the bare areas are no longer evident, and there is significantly more tree cover.

Diagnoses and prescriptions abound, but nowhere are two key parameters to successful agriculture production mentioned–land tenure and secure property rights.

There has been considerable investment in terracing, a technique which increases rainfall infiltration, and thus the moisture available for crop growth, by controlling runoff. Terracing requires hard, manual labor and is undertaken only when the returns to that labor are worthwhile.

Three factors underlie these dramatic changes in land management. First, the growth in the human population creates an “internal” market for higher production—more mouths to feed off the same area require higher productivity and, therefore, investment in land management. Second are the burgeoning “external” markets—local markets in neighboring towns and, more recently, the vast urban markets of Nairobi and other large towns. Finally, and most important, is the evolution of property rights from the customary tenure regimes of the 1930s to private, freehold tenure, with secure property rights enshrined in and enforced by secular law (specifically the amendments to the Registration of Titles Act of 1959).

Economic Productivity

Throughout the 80,000 square kilometers of the agricultural lands of Kenya, the tenure regime under which the land is being managed has a clear effect on net economic productivity. Nearly 14 percent of this land is held by individuals or commercial companies under leasehold tenure with 999-year or 99-year leases. Economies of scale and access to capital (both domestic and overseas) on these large (200–5,000 hectares) commercial farming units (see photo on page 35, lower left)—typically tea, coffee, or wheat—create net returns to agricultural and livestock production of $415 per hectare (2.5 acres) per year and generate 25 percent of total net agricultural and livestock revenues. Land under commercial leasehold tenure represents the most efficient farming system in Kenya, relying on high capital inputs rather than raw labor, and producing high value outputs for both export and domestic markets.

A further 36 percent of the land under private freehold tenure creates returns to agricultural and livestock production of $347 per hectare each year and generates 52 percent of annual net revenues. Labor is important to this intensive farming system, which supports nearly 66 percent of the rural population. Millions of smallholder (1–50 hectares) farmers in Kenya hold their land under private freehold tenure. They are a key pillar to the Kenyan economy and supply high value outputs to the burgeoning export and domestic markets.

The remaining half of the agricultural land is under a variety of traditional customary tenure regimes (see photo on page 35, upper right). This land produces the lowest net returns to agricultural and livestock production—$110 per hectare per year—and contributes to only 23 percent of annual net revenues. Moreover, population density is low, supporting only 24 percent of the rural population.

Kenyan landowners with secure property rights obtain higher net economic returns from their land. For every dollar of net agricultural production on land under traditional, customary tenure, $3.15 is produced on land under private freehold tenure, and $3.78 from land under commercial leasehold tenure.

Resource Management

There are clear differences between these tenure regimes in the investment in longterm land management (table 1, page 36). Investment in perennial crops with long planting cycles (tea, coffee, orchards) is highest on land under commercial leasehold tenure, while the greatest investment in managed woody vegetation (woodlots, wind rows, trees, and hedgerows) is found on land under private freehold tenure. Furthermore, as the proportion of land under private, freehold tenure increases, so too does the total area of land under active soil conservation—land managed with contour ploughing, tied ridging, or terracing.

These long-term perspectives in investment decisions about land management and production provide, in turn, significant environmental benefits, for the land is now being managed in a sustainable manner rather than with shorter-term time horizons. Clearly, landowners with secure property rights have a longer time perspective and invest more in land management and soil conservation.

The Great Economic Driver

Today, the great economic driver in Kenya is the burgeoning domestic market, itself a byproduct of urbanization. Nairobi alone transfers some $400–$500 million a year to the agricultural and pastoral hinterlands to meet its demand for agricultural and livestock products. The demand for greater quantity and quality of such goods and services is growing throughout Africa. Today, the Food and Agriculture Organization for the United Nations estimates the value of the urban market for food in Africa to be $47 billion—five times greater than the combined markets for exported food and commodities. They further predict this urban market to grow to $156 billion by 2030.

Rangeland production in Kenya has shown the same sort of response to the growth in both “internal” (population growth on rangelands) and domestic (primarily urban) markets. With more than 50 percent of the rangelands with agricultural potential now supporting cultivation, agricultural production is growing 8 percent per year, livestock sales at 4 percent per year, and wildlife is being eliminated. Associated with these changes is a rapid evolution of rangeland property rights from communal or group tenure to private tenure. The entire pastoral production system is in a state of flux with a fundamental switch from an extensive pastoral production system to a more intensive agro-pastoral system.

A further impact of urbanization is to drive up the value of land that lies on the periphery of cities so that it becomes dislinked from its agro-ecological potential. Twenty-five kilometers from Nairobi, in the middle of the semi-arid rangelands of the Athi-Kapeti plains, land is now worth nearly $9,000 a hectare, increasing in value at 12 percent per year—a rate better than treasury bonds. It is now simply too valuable for agriculture, livestock, or wildlife production, except as a holding operation until it realizes its new potential as housing estates or industrial parks.

Africa and Beyond

Sub-Saharan Africa has changed beyond all recognition over the past 20 years. From the viewpoint of the producer, internal (population density) and external (domestic rather than export) markets are burgeoning, primarily as a response to urbanization; information, transport and market networks are expanding; opportunities for investment abound; and credit is more freely available. Yet as we have seen in the agricultural lands of Kenya, only those with secure property rights and private freehold tenure have been able to latch onto these emerging opportunities. In western Africa, recent studies demonstrate how market demands, also driven by urbanization, are simply overwhelming traditional tenure regimes and forcing an uncontrolled transformation to private tenure—the essential prerequisite before the necessary investments can be made to take advantage of growing market opportunities.

Despite this trend, a vast dichotomy in the attitudes toward agricultural property rights in Africa still persists. On the one hand are the neo-classical economists promoting the case for private property rights and the associated potential for economic and social gain. On the other are the social engineers arguing that private property rights are somehow inappropriate for Africa and lead to social losses and few economic benefits, except to elites.

Africa is littered with the failed efforts of governments to impose state control over land allocation and land use, while the rural poverty over vast tracts of Africa serves as testimony to the price those still blighted by customary tenure regimes are expected to pay. Weak tenure regimes under centralized control are naturally favored by political and economic elites as they enable takings.

As Kenya demonstrates so clearly, people do what they do in response to economic incentives, but their ability to respond efficiently depends on the security of their property rights