In 2018, Yosemite National Park had the highest deferred maintenance backlog of any national park in the country, with $646 million worth of overdue maintenance projects. The park may have a long-overlooked source of funding to tap for maintaining and preserving the public’s access to its scenic grandeur: an outdated lease on part of its property.

The Hetch Hetchy Valley, located entirely within the park, provides water to San Francisco and other Bay Area communities. In addition, San Francisco receives approximately one-tenth of its power from hydroelectricity generated by the gravity-driven flow from the Hetch Hetchy Reservoir. The 1913 Raker Act authorized the unprecedented dam inside the park and also set the fee that the city pays to rent the entire valley in which the dam sits: $30,000 per year. It may be the worst contract in the history of the National Park Service.

While the lease price has remained constant over the past century, the value of the valley has not. Yosemite today is exceptionally congested—it is the fifth most visited national park—and restoring the Hetch Hetchy Valley would increase both the quantity and quality of recreational opportunities available to the park’s 4.5 million annual visitors. A benefits-transfer study conducted by a consulting firm calculated the potential recreational-use value of undamming the valley to be between $1.7 billion and $5.4 billion.

San Francisco’s water supply is also valuable. The city earns about $440 million annually from the sale of Hetch Hetchy water to its own customers and other municipalities. Thus, there is clearly a trade-off between keeping the dam and tearing it down. The former would continue to prevent recreation in the valley, while the latter would force the Bay Area to reassess its entire water supply. What is also clear is that under the current agreement, Yosemite, its visitors, and the American public are all losing.

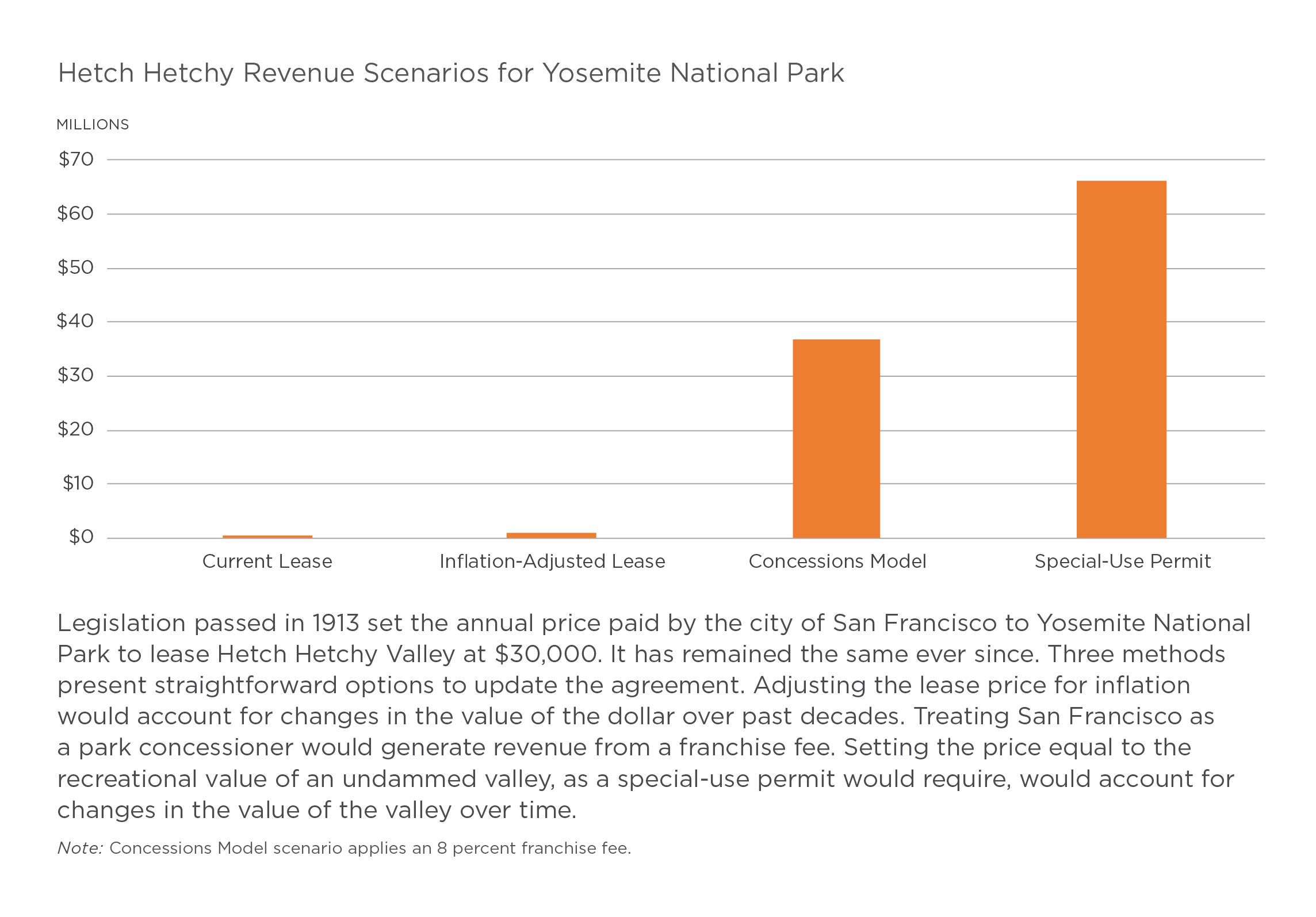

In light of the park’s needs, the annual lease price San Francisco pays could be adjusted to raise revenue that could help maintain infrastructure inside the park, a move that would also be consistent with how other national parks structure their concessions and special-use contracts. Three methods can provide a range of potential lease prices.

A more equitable payment to the park from the city for its use of Hetch Hetchy water would provide enormous benefits for the 4.5 million people who visit the park each year. It is time to update the century-old arrangement between Yosemite and San Francisco.

Options to Adjust Hetch Hetchy Lease Price:

- Account for inflation that has occured since the price was set by the Raker Act.

- Treat San Francisco as a National Park Service concessioner and charge a franchise fee according to agency rules.

- Set the annual price equal to the annual value of an undammed Hetch Hetchy Valley.

A Longstanding Windfall

A Longstanding Windfall

The deal to bring water from Hetch Hetchy Valley in Yosemite National Park to San Francisco has been a tremendous boon for the municipality for more than a century. The same cannot necessarily be said for the National Park Service. In fact, in 2018, the agency proposed moving its Pacific West Regional Office out of San Francisco in an attempt to save money on rent and salaries.

The existential debate over whether the valley should be dammed has largely overshadowed any discussion of San Francisco paying fair compensation for the benefits it receives from the resource. The city profits as the sole user of the valley, which provides its municipal water supply. Because gravity does the work, no pumping is required to deliver the water to San Francisco. The properties of the valley make the water so pure that the city does not need to use expensive treatment. San Francisco credits Hetch Hetchy with enabling it to make a $678 million transfer to its general fund from 1978-2001 and providing $151 million of cash-funded streetlights, city-owned solar panels, and similar energy investments.

While San Francisco is using the proceeds of Hetch Hetchy to invest in green infrastructure and streetlights, Yosemite struggles to maintain its roads, treat the wastewater from its visitors, and repair its bridges, buildings, and trails. One of three methods could be used to update the lease between the city and the park and find a more equitable arrangement.

Method 1: Adjust for inflation.

The simplest of the three proposed methods is to adjust the lease price for inflation. The 1913 fee of $30,000 is equal to approximately $800,000 in 2020 dollars. While this method captures the change in value of the dollar—$30,000 was worth a lot more in 1913 than it is today—it fails to account for the change in value of the valley.

Method 2: Treat San Francisco as a concessioner.

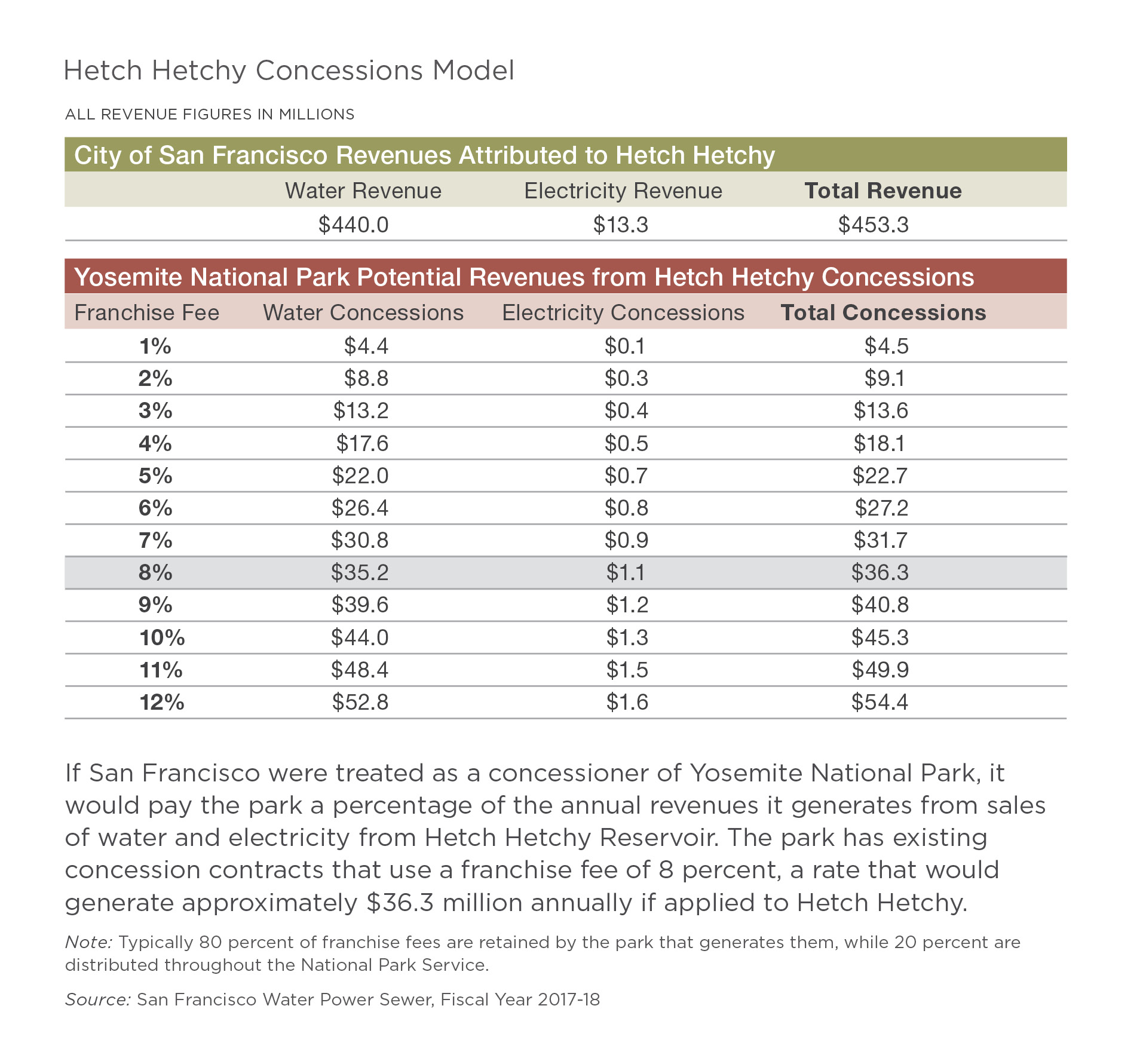

Private companies that offer services to national park visitors that parks do not provide directly are known as concessioners. Concessioners typically pay a franchise fee, which is calculated as a percentage of their gross revenue. While San Francisco may not meet the traditional definition of a concessioner, the model presents a framework to estimate a portion of revenues from the city’s Hetch Hetchy water and power sales that could be used to support Yosemite.

Concessioner franchise fees usually vary from as low as 3 percent to as high as 12 percent. Data from existing Yosemite concessioner contracts and the San Francisco Public Utilities Commission, therefore, can be used to estimate revenues for Yosemite National Park if the city’s Hetch Hetchy-derived revenues were treated as concessions revenue.

In fiscal year 2017-18, the San Francisco Public Utilities Commission reported an approximate daily water use of 192 million gallons per day, which equates to a total annual water delivery of about 70 billion gallons. Total sales revenue for that water was $518 million. Because 85 percent of San Francisco’s water sales were sourced from Hetch Hetchy, approximately $440 million of the city’s total water sales can be attributed to the reservoir.

The Hetch Hetchy power system also provides revenue for the city. The system consists of four hydroelectric powerhouses with combined output of 385 megawatts, and the two powerhouses that rely directly on the downhill flow of water from Hetch Hetchy Reservoir generate 215.5 megawatts. For fiscal year 2017-18, electricity sales attributed to the reservoir totaled approximately $13 million.

Combining the water and electricity revenues for 2017-18, San Francisco generated total sales of approximately $453 million that could be attributed to Hetch Hetchy Reservoir. Applying the range of franchise fees to the total generates estimates of potential annual revenue for the park of $4.5 million to $54.4 million. The park has existing concessions contracts that use a franchise fee of 8 percent. Using the 8 percent franchise fee and assuming water and electricity sales consistent with 2017-18 values, Yosemite National Park would receive $36.3 million annually by allowing the city of San Francisco to benefit from its water resources in Hetch Hetchy.

Method 3: Estimate the value of an undammed valley.

The National Park Service is authorized to collect special-use fees for short-term activities that take place in parks. Such activities occur when the use:

[P]rovides a benefit to an individual, group or organization rather than the public at large; requires written authorization and some degree of management control from the NPS [National Park Service] in order to protect park resources and the public interest; is not prohibited by law or regulation; is neither initiated, sponsored nor conducted by the NPS …

Although the damming of Hetch Hetchy Valley was not short term, it resembles a special use in that it does not provide benefits to the public at large and is made legal by the Raker Act. Specifically, it resembles a right-of-way permit, a particular category of special-use permit that allows a utility to pass through, under, or over park property.

The customary way to determine National Park Service fees for right-of-way permits is to use market rent, defined by the Department of Energy as “the most probable rent that a property should bring in a competitive and open market reflecting all conditions and restrictions of the lease or permit agreement … ”

Unfortunately, there are no comparable market transactions to provide a basis for calculating the market rent of the entire Hetch Hetchy Valley. The National Park Service reference manual for special park uses, however, provides an alternative methodology that can inform an estimate of an appropriate price for the services the valley provides. According to the manual, the fee charged for a special-use permit should “reflect the fair market value of the use requested.” In this case, it can be estimated as the annual value of an undammed Hetch Hetchy Valley. One study estimated the present value of undamming the valley to allow for recreational use to be between $1.7 billion and $5.4 billion. Using the low-end estimate of $1.7 billion and a conservative discount rate of 3 percent yields an annuitized value that could be used to set the annual lease price: $66 million.

Conclusion

When the Raker Act passed, its proponents assured the public that the reservoir would bring not only a reliable water source to San Francisco, but also great public enjoyment. As of 2020, however, no public transportation exists to access Hetch Hetchy Valley, and appeals to allow boating and swimming in the reservoir have been repeatedly denied. Hetch Hetchy Reservoir, encompassing 2,000 acres of federal park land, has clearly been maintained for the benefit of San Francisco with minimal consideration of the wider public whose tax dollars—and, in the case of visitors, entrance fees—support the national park.

The three methods for determining a more equitable price for use of Hetch Hetchy Valley generate a wide range of values. Adjusting for inflation would provide the most modest benefits to the park at $800,000 per year. Another estimate comes from treating San Francisco as something akin to a concessioner. The Commercial Services Program, which oversees concession contracts within National Parks, generally allows 80 percent of franchise fees to be used within the park where they are collected and 20 percent to be distributed to other units throughout the park service. A similar contract structure between Yosemite National Park and San Francisco with a franchise fee of 8 percent would generate approximately $36 million dollars annually. Lastly, charging San Francisco the annual value of an undammed Hetch Hetchy Valley would provide Yosemite National Park with an extra $66 million in funding per year.

Yosemite’s current discretionary budget is about $30 million per year, and the park also receives other allocations for special projects and activities and generates additional revenue from sources such as recreation fees and philanthropic donations. A fairer contribution from the park’s largest “concessioner” would greatly benefit the 4.5 million people who visit annually. It is time to modernize the century-old arrangement between Yosemite and San Francisco.

Download the full report, including endnotes and references.