DOWNLOAD THE FULL REPORT

DOWNLOAD THE FULL REPORT

Introduction

Congress created the Land and Water Conservation Fund (LWCF) in 1965 to help “preserve, develop, and ensure access to outdoor recreation facilities to strengthen the health of U.S. citizens.”1 Throughout its 51-year history, Congress has appropriated funds under the provisions of the LWCF for a variety of purposes, including state outdoor recreation project grants and the acquisition of federal lands.

The authorizing legislation for the LWCF expired on September 30, 2015. In response, Congress included a temporary, three-year extension of the LWCF in the omnibus appropriations bill in December 2015. Several proposals to permanently reauthorize the LWCF now sit before Congress.2 Meanwhile, critics of the LWCF argue that major reforms are needed, particularly to the allocation of funding to various purposes.3

Amidst the political rhetoric over the reauthorization of the LWCF, several misconceptions have emerged about how the LWCF works and what purpose it serves. In the process, policymakers and other observers have overlooked and misconstrued critical facts. In this PERC Policy Brief, we address common misconceptions about the program and offer several ideas for reform.

MYTH 1: The majority of LWCF funding goes to local outdoor recreation projects.

FACT: The stateside grants program makes up a small and shrinking share of LWCF funding. The majority of LWCF funds are used to expand the federal estate.

The Land and Water Conservation Fund is the federal government’s principal financing mechanism for federal land acquisition, and until 1975 it was a significant source of funding for state and local outdoor recreation projects. Each year, the LWCF is credited with $900 million, largely derived from revenues from offshore federal oil and gas leases.

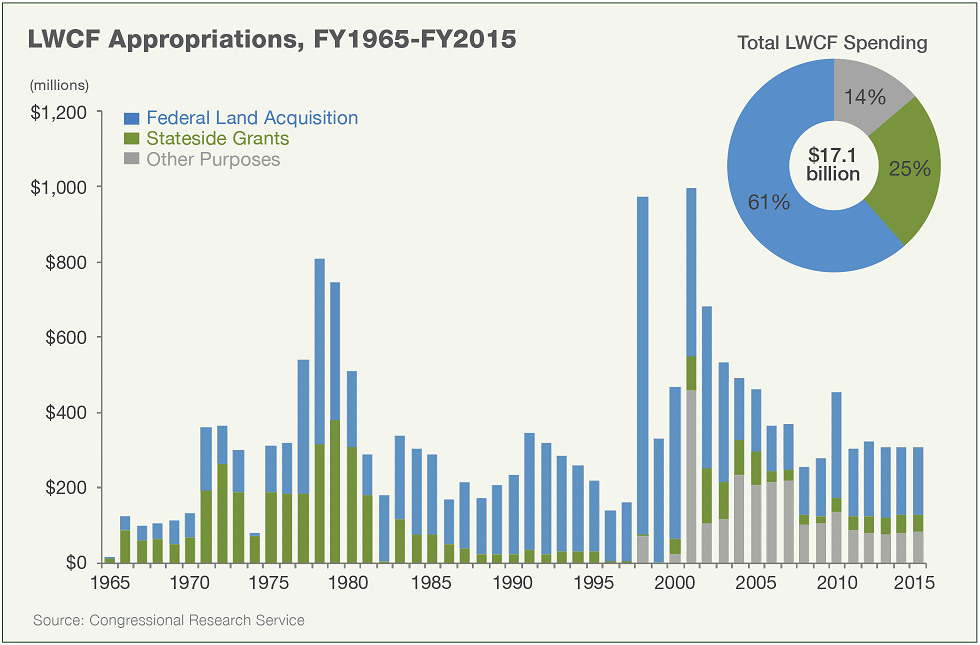

Although the LWCF is authorized at $900 million per year, any actual LWCF spending must be appropriated by Congress each year. The total amounts appropriated through the LWCF for its multiple stated purposes have varied substantially since the origin of the program (see Figure 1). In practice, Congress has rarely appropriated the full $900 million authorized per year. Since the program began, more than $37 billion has been credited to the LWCF, but as of 2015 less than half of that amount ($17.1 billion) had been appropriated by Congress for LWCF purposes.4

Figure 1:

Congress appropriates LWCF funds for three general purposes: federal land acquisition, stateside matching grants, and a third category referred to as “other federal purposes.” The LWCF is the primary source of funding for federal land acquisition by the four major federal land agencies: the National Park Service, U.S. Forest Service, Bureau of Land Management, and U.S. Fish and Wildlife Service. The stateside matching program directs a portion of the LWCF annual appropriations to matching grants to states for outdoor recreation planning, land acquisitions, and recreation facility development. The third category—“other purposes”—is a catch-all category that has been used by Congress since 1998 to devote LWCF funds to a variety of federal natural-resource related purposes other than federal land acquisition.

Throughout its history, the majority of LWCF appropriations (61 percent) has gone toward federal land acquisition, amounting to $10.5 billion.5 These acquisitions have resulted in a total expansion of federal landholdings of more than five million acres—an area equal to the size of New Jersey.6

The state outdoor recreation grant program, administered by the National Park Service, has provided more than 42,000 grants for outdoor recreation projects throughout the United States, ranging from local parks and greenspace to ballparks and playgrounds.7 Calls to permanently reauthorize the LWCF often point to the popularity of the stateside program; however, since the LWCF was enacted, the stateside program has received only 25 percent of the total LWCF appropriations, or $4.2 billion.8 Initially, states received the largest amounts of LWCF appropriations, but in the late 1970s the majority of LWCF funds shifted to federal land acquisitions. Since 2010, only 13 percent of LWCF allocations have gone to the stateside program.

Since 1998, Congress has also appropriated funds through the LWCF for “other federal purposes,” totaling $2.4 billion as of 2015. There are few restrictions on Congress’s discretion to appropriate funds for the “other purposes” category. LWCF appropriations in this category have been provided for a variety of natural resource-related programs, including facility maintenance for land management agencies, ecosystem restoration, the Historic Preservation Fund, the Payments in Lieu of Taxes program, the Forest Legacy Program,9 state and tribal wildlife grants, the Cooperative Endangered Species Conservation Fund, U.S. Geological Survey science and cooperative programs, and Bureau of Indian Affairs Indian Land and Water Claim Settlements.10

MYTH 2: The LWCF directs $900 million per year into a fund for land and water conservation.

FACT: There is no dedicated LWCF fund. It is a political and accounting fiction.

A persistent source of confusion about the LWCF is the belief that there is a dedicated amount of federal funding set aside in a “fund” for exclusive use according to the purposes of the Act. But in reality, there has never been such a fund, nor has there ever been any requirement that Congress must appropriate certain amounts of LWCF funding for specific purposes.

Each year, Congress considers requests for LWCF funding by federal agencies and other state and local recreational needs. It then allocates levels of funding through the standard appropriations processes in the same way it allocates any other federal appropriated funding. Other than a small amount of dedicated money from certain oil and gas leases in the Gulf of Mexico, Congress has no obligation to appropriate any specific amounts of funding for the recreation and land acquisition projects targeted by the LWCF authorizing legislation.11

Congress, therefore, could legally appropriate close to zero dollars for public outdoor recreational and other conservation purposes without coming into conflict with the LWCF legislation. In fact, there have often been large variations in appropriations from year to year. In 2009, for example, Congress appropriated $275 million for LWCF purposes, followed by $450 million in 2010. In 2015, Congress appropriated only $306 million of the $900 million authorized for LWCF purposes.12

In its official report language concerning its final appropriations decisions, Congress typically says that funds are being appropriated from the LWCF. But there is no “fund,” nor is there any requirement to spend a specific amount of money for LWCF purposes. The existence of a LWCF “fund” is merely a political fiction.

In practice, LWCF funds consist of a designated U.S. Treasury account under that name. But there are many other such U.S. Treasury accounts. For example, the federal Reclamation Fund, a Treasury account dating back to the Mineral Leasing Act of 1920 intended to promote dams and other water projects, still legally receives 40 percent of federal onshore mineral leasing revenues each year. When a Treasury account is not legally dedicated to a specific purpose, however, it is not meaningful to say that Congressional appropriations actually come from any one account. In practice, LWCF “funds” simply draw from the same overall pool of total Treasury financial resources available for whatever Congress appropriates in a given year. Federal dams and other water projects, for example, have never been actually funded by the Reclamation Fund. Thus, when congressional appropriations committees supposedly “allocate” public funds to LWCF projects, in reality it is the same as allocating funding for any of a wide range of other federal purposes.13

In short, the reality is that the federal cost of LWCF appropriations is financed in either one of three ways: 1) Federal taxes can be raised to cover the LWCF appropriations; 2) other forms of federal spending can be reduced in order to free up Treasury resources for the LWCF appropriations; or 3) the federal government can borrow additional money to accommodate LWCF appropriations, thereby increasing the federal deficit and transferring the payment obligations to future generations.

The LWCF fund is thus, in reality, a political and accounting fiction. The existence of the LWCF might then be said to have no practical significance, except as a political tool to influence the federal appropriations process.

MYTH 3: The LWCF costs taxpayers nothing.

FACT: When funds are allocated through the LWCF, less funding is available for other federal priorities.

Proponents of certain forms of federal spending, such as federal land acquisition or stateside grant funding, often take advantage of public confusion about the true workings of the LWCF to advocate higher spending levels for their own favored purposes. For example, such groups often suggest that an actual dedicated LWCF “fund” exists, and that LWCF funds must be appropriated for the purposes specified in the Act or they will remain unspent in a dedicated LWCF fund.

Such large misrepresentations—whether due to simple confusion or the purposeful spreading of false information—have become widespread in the latest public debates over the LWCF. They imply that it is unnecessary for Congress to engage in its usual priority setting, in which all public funding needs compete for appropriations. The LWCF is effectively cast as a free lunch for conservation and recreation purposes.

Advocates also claim that because the LWCF is funded from oil and gas sources, Congressional appropriations for LWCF purposes do not come at any actual cost to the federal government or to American taxpayers, as demonstrated in the recent examples below:

- “Every day, the [LWCF] fund generates about $2.5 million, from leases on offshore oil and gas drilling. So nothing comes directly from taxpayers.” — Timothy Egan (New York Times, October 23, 2015).14

- “The Land and Water Conservation Fund isn’t taxpayer-funded. Since 1964, the government has redirected money from offshore oil and gas drilling into the fund, directing it toward conservation projects at the local, state, and federal level.” — Robinson Meyer (The Atlantic, September 17, 2015).15

- “The LWCF is funded using royalties on offshore oil drilling — it doesn’t cost taxpayers a dime.” — Aaron Weiss (Center for Western Priorities, July 30, 2015).16

Commentators such as the ones listed above are creating the false impression that the appropriations from the LWCF are being paid by oil and gas companies themselves—as if there is a special LWCF “tax” on offshore oil and gas development. In reality, however, the total Outer Continental Shelf oil and gas bonus bid and royalty revenues are fixed by the entirely separate and longstanding provisions of the federal offshore oil and gas leasing system. The level of these total revenues in any given year is determined in a manner altogether independent of the existence of the LWCF. In practice, the LWCF “revenues” are simply taken from one Treasury account (general revenues into which OCS revenues are directed) and shifted to another (the LWCF), both of which are available for any Congressionally appropriated purposes. Claiming that the LWCF funds are taken from the oil and gas industry is just another rhetorical misrepresentation for the purposes of political advocacy.

In short, funds that are “spent” from the LWCF are funds that would otherwise have been available to Congress and the U.S. Treasury to meet any national needs that Congress might have determined to be most urgent. Thus, in practice, the true cost of the LWCF is borne by all Americans who pay taxes and who receive reduced federal benefits in other areas as a result of funds appropriated through the LWCF.

The ultimate lesson of the LWCF is that there is no free lunch when it comes to federal budgets. Unless there is an actual dedicated fund, spending on any federal project comes at the expense of another potential project, or foregone tax cuts or deficit reduction. To claim otherwise reflects a fundamental misunderstanding of the nature of the federal budgeting and appropriations process and of the real existence of economic opportunity costs in making funding commitments such as LWCF appropriations.

MYTH 4: The LWCF is critical to protect public lands for future generations.

FACT: Congress has used the LWCF to expand the federal estate without adequately funding the maintenance and conservation of existing public lands.

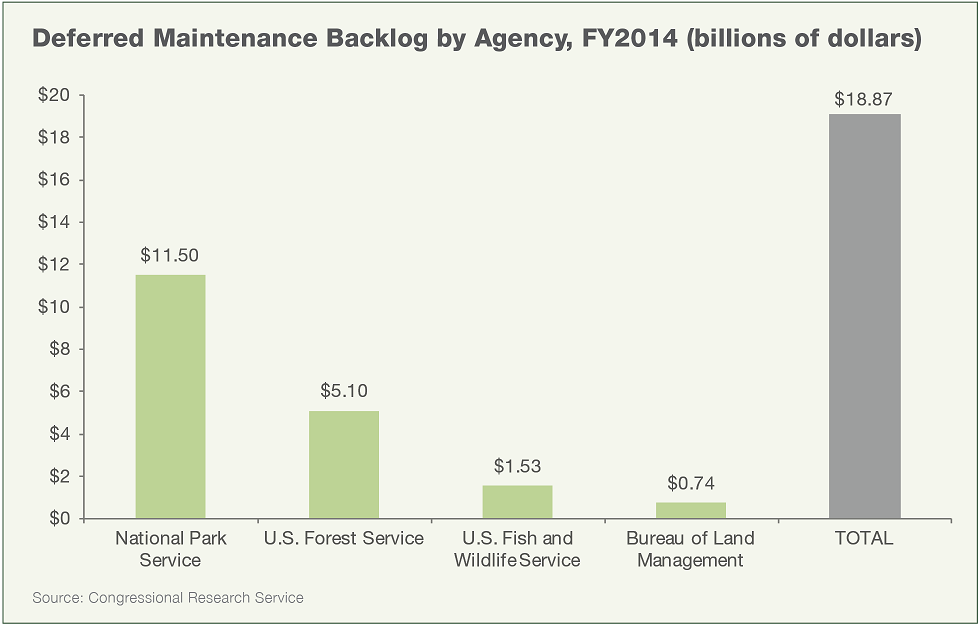

The LWCF creates political pressures on Congress to allocate funding for the specific purposes authorized under the Act, such as federal land acquisition, which has received the majority of LWCF funds. Today, however, there are arguably more urgent needs on public lands than simply acquiring additional federal lands. Federal land agencies are already so short of funds that they are often unable to meet their basic statutory purposes or perform the basic management and maintenance functions necessary to ensure their protection (see Figure 2).

Figure 2:

The federal government currently owns roughly 640 million acres of land across the United States, including nearly half of the land in western states.17 The magnitude of the unfunded needs on current federal lands is staggering. The National Park Service alone has a deferred maintenance backlog of nearly $12 billion.18 Yellowstone and Yosemite, two of the most iconic parks, each face more than half a billion dollars in unmet maintenance needs.19 Overall, the total deferred maintenance backlog across all federal land agencies amounts to approximately $18.9 billion.20 This backlog includes the wastewater system repairs, campground and trail maintenance, building repairs, and transportation infrastructure necessary for people to access and enjoy public lands.

Several LWCF reform efforts have focused on making the maintenance and management needs on existing federal lands a higher priority for Congressional appropriations. Compared to current appropriations for federal land acquisition, devoting more money for the maintenance of roads, campgrounds, trails, and other genuine outdoor recreational spending on federal lands would arguably do more to advance the original purpose of the LWCF.

Federal land managers themselves have voiced concern that the care and maintenance of existing federal lands is more important than acquiring inholdings or other new federal lands. Testifying before the House Subcommittee of Federal Lands in March 2015, National Park Service director Jon Jarvis acknowledged that the deferred maintenance backlog is a higher priority than acquiring inholdings.21 Yet Congress continues to devote the majority of funds appropriated through the LWCF to federal land acquisition.

Despite this acknowledgement, some argue that reforming the LWCF to explicitly address critical maintenance needs would amount to “raiding the LWCF.”22 But prioritizing the care and maintenance of existing federal lands is the opposite of raiding—it is the definition of responsible conservation. Moreover, it is consistent with the original intent of the LWCF, which is to “preserve, develop, and ensure access to outdoor recreation facilities.”

MYTH 5: Permanent reauthorization will advance the original goals of the LWCF.

FACT: The LWCF must be reformed to advance its original purpose. Without reform, the LWCF should be terminated.

In light of the above facts, the Land and Water Conservation Fund must be reformed if it is going to fulfill or advance its original purpose. Otherwise, it should be terminated. Popular misconceptions about the LWCF—including the supposed lack of costs to the American taxpayer—warp the political process of federal priority setting and for overall federal expenditures as well. Acquiring more federal land at a time when the federal land management system is itself in a state of crisis seems a particularly perverse outcome.

One approach to reforming the Act is to increase the portion of LWCF funding dedicated to the stateside program. It is important to note, however, that even without much federal assistance, states and local governments have already taken charge of their own conservation and recreational demands themselves. Since 1988, more than $72 billion in expenditures for conservation purposes has been approved in ballot initiatives by state and local voters.23 There is seemingly no compelling need for an additional large federal role in state and local outdoor recreation that would inevitably be ensnarled in greater rules and regulations.

Congress has to some extent recognized the need for using LWCF “funding” for a wider range of activities. Besides federal land acquisition and state grants, the LWCF also provides for appropriations to the category of “other purposes.” Since 1998, the “other purposes” category has occasionally been the largest category of LWCF funding. When such large sums are appropriated to this catch-all category, it amounts to a tacit acknowledgement that the LWCF has outlived the original goals that led to its creation, or that the other categories of LWCF funding are insufficient.

Opportunities for Reform

Whatever the realities of the LWCF, the program is widely perceived by much of the general public as a success, so policymakers may find it necessary to continue the LWCF in some form. In that case, incremental changes should be made. Even without altering the LWCF authorizing legislation, some of these could be implemented by simply changing the types of appropriations Congress authorizes under the LWCF.

1. Sharply reduce the level of federal land acquisitions.

With nearly $19 billion in unfunded maintenance needs on existing federal lands, it is impractical and irresponsible to appropriate funds through the LWCF to acquire more federal property. Congress should ensure that existing federal lands are adequately cared for before funds are used to acquire more federal land. If additional land acquisitions are desired, direct the LWCF funds to the states for their own acquisition efforts, which are more likely to serve broad-based recreational demands.

2. Negotiate easements or land exchanges instead of acquiring land outright to improve public access.

Where improved public access to federal land is needed across private lands, the use of easements or land exchanges—voluntarily negotiated with private landowners—should be the primary means of providing this access, thus keeping land in the local tax base and available for private recreational development. In this respect, the Forest Legacy Program, which provides funding for easements on private lands and has received LWCF appropriations through the “other purposes” category since 2004, is preferable to direct federal land acquisition.

3. Redirect LWCF appropriations for maintenance spending and other critical needs on existing federal lands.

This could include increased funding for areas such as deferred maintenance, habitat restoration, management shortfalls, and reductions of excess fuels in federal forests.

4. Clarify the criteria for appropriating LWCF funds to the “other purposes” category.

New authorizing legislation is not necessary to significantly alter the pattern of LWCF funding, including the possibility of addressing the deferred maintenance challenges within the National Park Service and other federal land agencies. Congress should, however, clarify that these purposes are justified within the LWCF and identify new conservation or recreation goals of high Congressional priority.

5. In the longer run, enact legislation to partially fund the LWCF from the sale of excess federal land and other federal properties in and near urban areas.

Some federal agencies have identified isolated parcels of federal lands that are suitable for disposal, with the potential to generate hundreds of millions of dollars for higher-priority conservation and recreation purposes. Congress should enable the sale of these scattered parcels and dedicate the revenues to the LWCF.

Conclusion

The Land and Water Conservation Fund is in need of reform. Popular misconceptions about the LWCF—such as the existence of a dedicated fund and the lack of costs to taxpayers—warp the political process to advance particular types of public spending, such as federal land acquisition. Given the magnitude of unfunded needs on existing federal lands and the tradeoffs that exist with any form of federal spending, the current approach is unlikely to fulfill the original intent of the law. Without significant reforms, it is difficult to see what useful purpose the LWCF serves, other than as a political tool to promote certain forms of federal spending. The reforms outlined in this report will help address new conservation and recreation priorities, improve the management of existing federal lands, and realign the LWCF closer to its original intent.

Download the full report, including endnotes and references.

DOWNLOAD THE FULL REPORT

DOWNLOAD THE FULL REPORT